Why Accounting Jobs Will Still Be Secure For 2021 Grads While The Economy Crashes

Grads in the class of 2021 are entering the world at a scary time. Months before the Coronavirus pandemic, the market was seeing waning R.V. sales, an inverted yield curve and declining copper prices. These were all signals that something bad may have been coming.

We just didn’t know how bad.

The idea of a down economy can be pretty frightening for someone fresh out of college. It spells less opportunity in the workforce and their specific major might not have jobs available at graduation.

The average college grad gets their diploma with a bill of $35,359 dollars, according to Experian.

One group of students can rest easy, though, knowing that their employment prospects will not change very much. Even with an economic downturn continuing to unfold, the accountants are pretty safe.

As my undergrad tax professor (also a former accounting partner) said, “Bad economy or good economy, everyone needs accountants.”

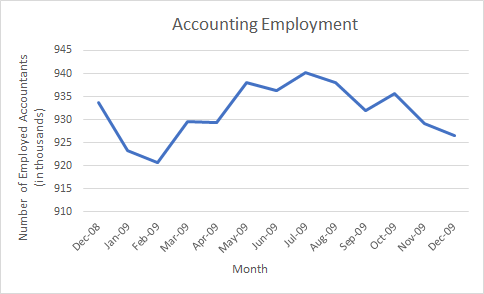

He was right. Looking back at the Bureau of Labor Statistics’ data from December 2008 — December 2009, accounting and bookkeeping jobs were nearly the least affected in terms of unemployment fluctuation.

Let’s be clear: I’m not saying that accounting is easy. A lot of people go in for two or three years after graduating school, then pass the CPA exam. After that, they move into a 40-hour per week corporate financial job.

The point is, they have a job. One that pays a decent starting salary for chipping away at their loans.

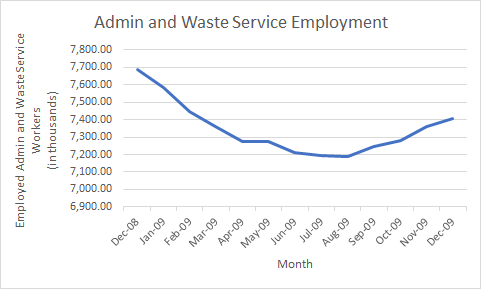

Compare the graph above to employment rates in the not-so-far-off “Admin and Waste Service” area:

According to that data, many people doing clerical work in 2009 were getting let go by large numbers. The chances of accountants losing their jobs were a lot less, however. The crazy part is that the clerical jobs were probably entering data into spreadsheets for the accountants to use!

Internships are even better. Despite occasional 14-hour days during tax season, the hourly wage for a public accounting intern in 2009 was around $20. That’s according to Big Four Accounting Firms, a leading accounting website. Interns are often making more during their January-April 15th stints than salaried 1st year associates!

Plus, many accounting internships can be work from home jobs and no one needs to worry about going into an office.

If you’re hesitant to explore it as a potential major because the classes sound difficult, look at my personal experience. 80% of success was showing up when it came to my accounting degree (and some hard work!). Don’t pass it off as “too difficult” or “not for you” just, because. My final accounting grade was somewhere in the “C” range, but I still have a range of employment options.

There are also a handful of different accounting jobs.

Don’t let a 90 hour tax week horror story scare you away from the industry.

The main types of entry level accounting positions are:

- Auditor

- Staff Accountant

- Tax Accountant

- Bookkeeper

- Cost Accountant

- Forensic Accountant

- Consultant (in public accounting)

On the website for the American Institute of Certified Public Accountants, they provide in-depth articles on the above-mentioned positions.

A handful of non-accounting classmates of mine are also now in accounting roles since graduating. From personal experience, most learning is done on the job for most positions, anyway. It should really be on your radar as an option, even if your major was something else within business.

The biggest thing to bear in mind is that a bad depression is coming each day that the virus grows. Instead of crossing your fingers that there’s a marketing job open when you graduate (those in the classes of 2022 and ’23), maybe it’s time to hedge your luck and consider accounting as a career path.

Data Sources:

https://www.bls.gov/news.release/archives/empsit_03062009.pdf

https://www.bls.gov/news.release/archives/empsit_08072009.pdf

https://www.bls.gov/news.release/archives/empsit_01082010.pdf

https://www.experian.com/blogs/ask-experian/state-of-student-loan-debt/